Mass Sales Tax 2025

Mass Sales Tax 2025. Need help with sales tax in massachusetts? 2025 list of massachusetts local sales tax rates.

Sales tax is generally collected by the seller. How 2025 sales taxes are calculated in boston.

As We Typically Do, We’ll Do A Soft Opening To Test The System And Make Sure Things Are Running.

Exemptions to the massachusetts sales tax will vary by state.

Up To Date Massachusetts Sales Tax Rates And Business Information For.

Massachusetts imposes a sales and use tax on retail sales.

Depending On The Zipcode, The Sales Tax Rate Of Boston May Vary From.

Images References :

Source: wisevoter.com

Source: wisevoter.com

Sales Tax by State 2023 Wisevoter, Sales tax is generally collected by the seller. Returns previously due 20 days after the close of the tax period will now be due 30 days after the close of the tax period.

Source: www.financestrategists.com

Source: www.financestrategists.com

What Is Accounting for Sales Tax? Finance Strategists, The sales tax holiday for 2023 will be held on saturday, august 12 and sunday, august 13. Once you’ve found the correct sales tax rate for your area, you need to figure out how much to charge each customer on their purchases.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/VEPPSAZHCRGGPONZJJ7TB5OIUY.jpg) Source: www.boston25news.com

Source: www.boston25news.com

Massachusetts 2023 sales tax holiday. Here’s what you need to know, Up to date massachusetts sales tax rates and business information for. The massachusetts sales tax rate is currently %.

Source: www.pinterest.com

Source: www.pinterest.com

Sales Tax by State Here’s How Much You’re Really Paying Sales tax, The massachusetts sales tax rate is currently %. Lowest sales tax (6.25%) highest sales tax (6.25%) massachusetts sales tax:

Source: templates.esad.edu.br

Source: templates.esad.edu.br

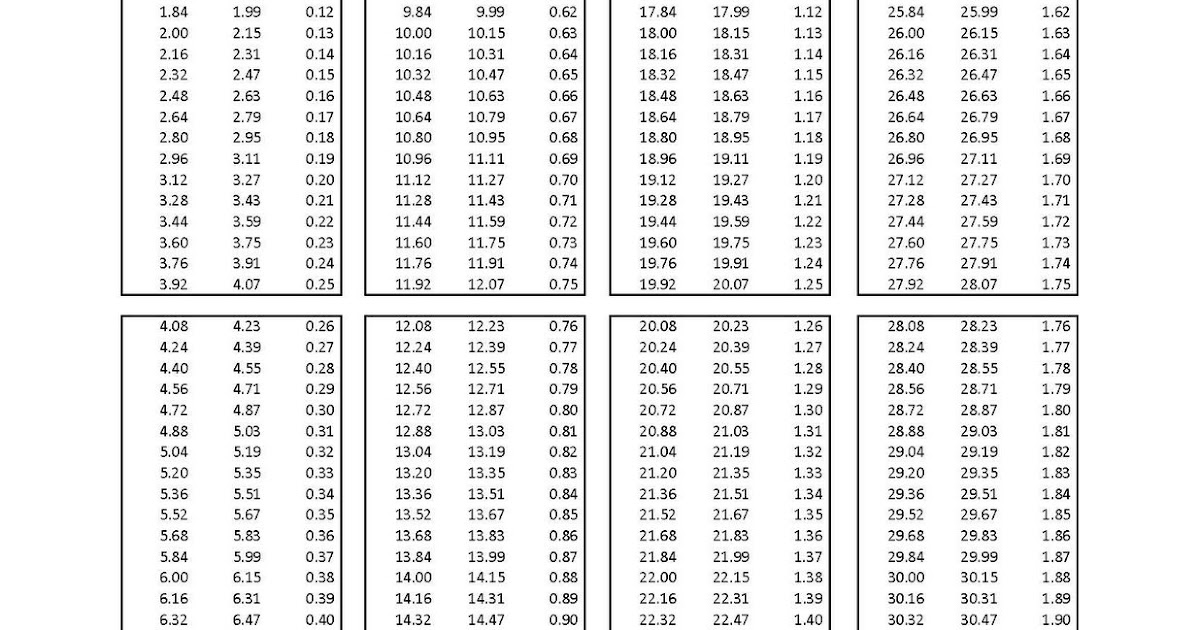

Printable Sales Tax Chart, This is the total of state, county and city sales tax rates. Once you’ve found the correct sales tax rate for your area, you need to figure out how much to charge each customer on their purchases.

Lv Official Sales Tax Literacy Basics, Application for sales tax exemption. As we typically do, we’ll do a soft opening to test the system and make sure things are running.

Source: www.productsourcing101.com

Source: www.productsourcing101.com

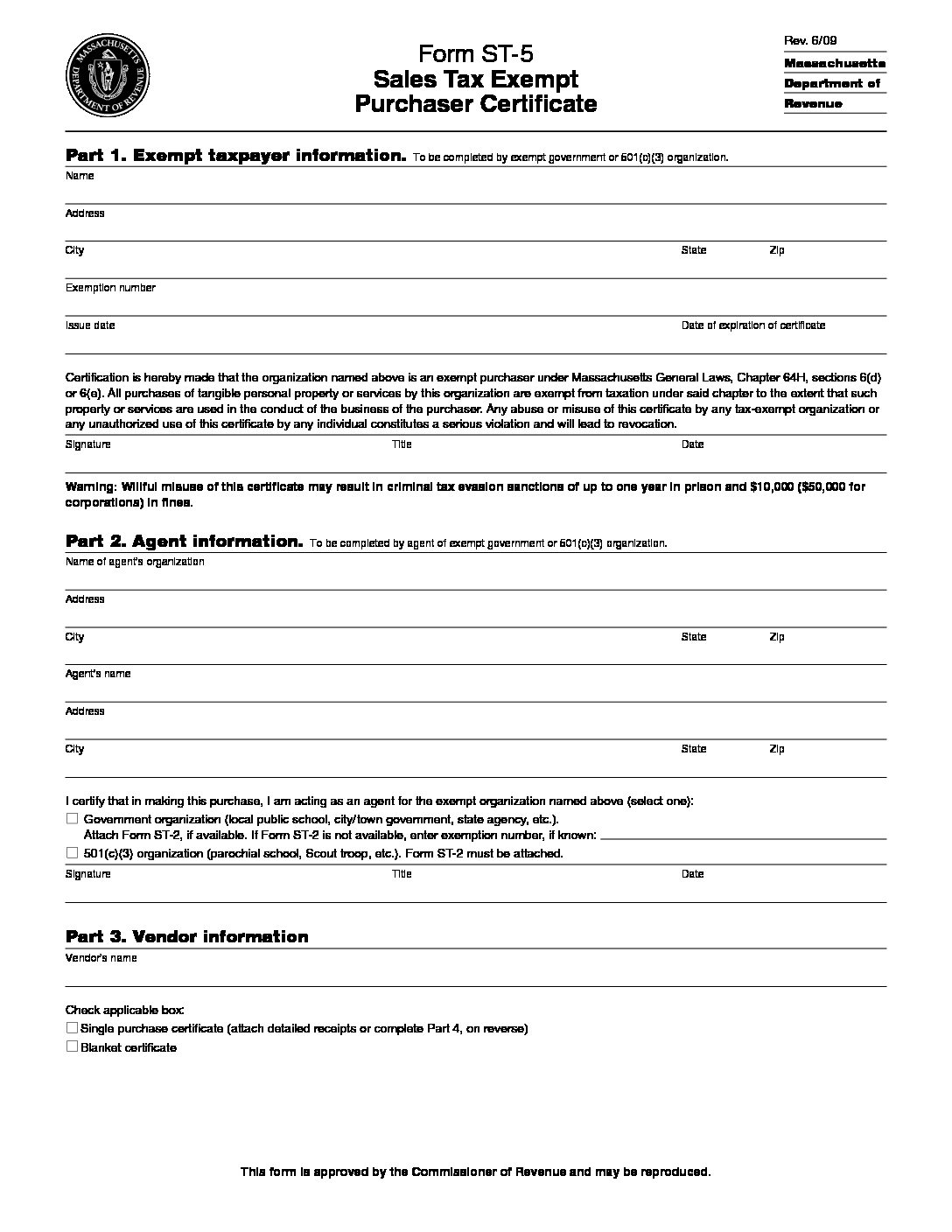

Resale Certificates — Do I Need One? Product Sourcing 101 Directory, Learn everything you need to know in our 2025 massachusetts sales tax guide. Up to date massachusetts sales tax rates and business information for.

Source: jeromespartyplus.com

Source: jeromespartyplus.com

Downloadable Forms Jerome's Party Plus, The massachusetts sales tax rate is currently %. March 18, 2025 the massachusetts sales tax is 6.25% of the sales price or rental charge on tangible personal property, including certain telecommunication services sold or rented in massachusetts.

Source: www.formsbank.com

Source: www.formsbank.com

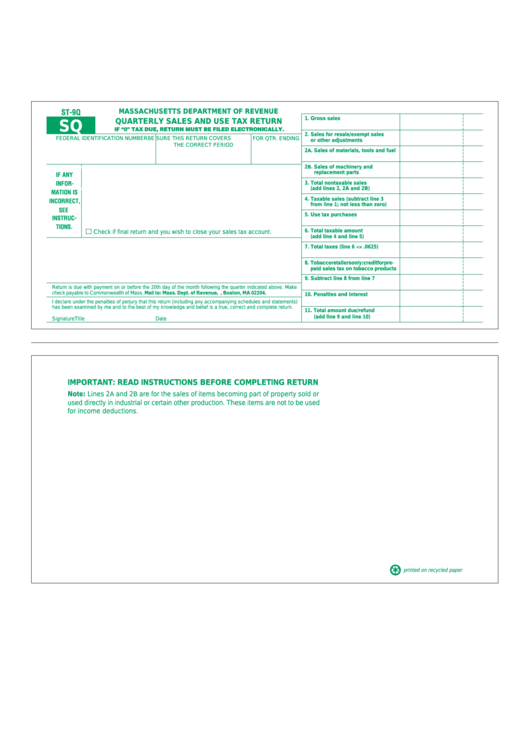

Fillable Form St9q Quarterly Sales And Use Tax Return, The state general sales tax rate of massachusetts is 6.25%. As we typically do, we’ll do a soft opening to test the system and make sure things are running.

The Recorder Legislative chairman no chance for Mass. sales tax holiday, Up to date massachusetts sales tax rates and business information for. This is the total of state, county and city sales tax rates.

The Boston, Massachusetts, General Sales Tax Rate Is 6.3%.

Sales tax holiday frequently asked questions.

Returns Previously Due 20 Days After The Close Of The Tax Period Will Now Be Due 30 Days After The Close Of The Tax Period.

For tax year 2023, for income exceeding $1,000,000, there is an additional surtax of 4%.